Some argue that money is nothing more than a piece of paper. However, when we use this figurative word, we don’t even try to guess how close we are to the truth. Take a look at a few examples of catastrophic hyperinflation in history from various ages and places to discover how money can be worth less than the raw material needed to produce it.

Hyperinflation is not a recent occurrence in the economy. During the French Revolution at the end of the 18th century, a large-scale depreciation of money happened for the first time.

According to historical records, money depreciates about 143 percent per month. This amount was the absolute world record until the beginning of the twentieth century, when 17 cases of hyperinflation in other regions of the world snatched the dubious palm from the French.

According to American Johns Hopkins University economics expert Steve Hanke, there has never been hyperinflation where goods were resolved or currencies were exchanged directly for things. Money depreciates only when the money supply is unrestricted and governed solely by standards and rules.

In a culture where the exchange of coinage for goods was the norm, fighting inflation was simple. Silver coins began to lose value around 1124, during King Henry I’s reign. This was because the grade of the metal used in coinage had deteriorated.

Any currency that is not backed by tangible assets is vulnerable to inflation, but political and social conditions are required for rapid growth. All of the hyperinflation situations described below are good proof of this assertion.

1. Germany hyperinflation in 1923

Following the end of World War I, Germany experienced unparalleled hyperinflation. War-torn industry, massive debts, and restitution commitments all made their presence felt.

The government began issuing stamps in large quantities in order to exchange them for hard cash and pay off foreign debts, causing money to depreciate.

Prices doubled every three days, and inflation peaked at 29,500 percent each month in October 1923, already under the Weimar Republic. The cost of bread is one example of rising costs. In Berlin, a loaf of bread cost 250 marks in January, but by November, the price had risen to 200 billion marks.

2. Hungary hyperinflation in 1946

Hungary had Europe’s greatest severe and long-lasting hyperinflation, which began after World War I and lasted until World War II. Following the breakup of the Austro-Hungarian Empire, the country adopted a new currency, the pengo. The government hoped that by doing so, the economy would be strengthened and foreign debts would be paid off.

When the expected effect was not achieved, the central bank of the country depreciated the currency to pay rising budgetary costs. By the start of World War II, money was being printed wildly on demand from the government, resulting in unparalleled depreciation.

National prices doubled every 15 hours, and hyperinflation reached 41.9 quadrillion percent by July 1946. The value of all Hungarian money in circulation was 1/1000 of a US dollar.

3. Greece hyperinflation in 1944

Greece experienced the worst case of hyperinflation in October 1944. The country’s prices doubled every four days, with a monthly inflation rate of 13800 percent.

Economic troubles arose as a result of the Nazi occupation of the country, which lasted 1.5 years.

If Greeks retained the drachma on average for 40 days before spending it in 1938, they only kept it for around 4 hours in the fall of 1944.

If the greatest denomination in circulation in 1943 was 25,000 drachmas, banknotes with a face value of 100,000,000,000,000 drachmas arrived by the end of 1944.

4. Zimbabwe hyperinflation in 1998

Zimbabwe, an African country, set the absolute global record for hyperinflation in the early 1990s of the twentieth century. The Zimbabwean dollar, which was arrogantly valued at 1.25 US dollars, was created in 1980 as a new monetary unit.

The rate of this currency was more or less constant for a while, but land reform began in 1990.

The country’s ethnic Europeans were exiled, and their lands were given to local Zimbabweans. Locals were not particularly interested in working in the fields, and the country’s economy began to sag.

The violence in the neighboring Congo depreciated the Zimbabwean currency in 1998, and US sanctions implemented in 2002 effectively ended it.

In 2007, things were so terrible that landlords chose to collect rent in maize flour and vegetable oil.

Toilet paper and sugar worth more than a dollar were also in use. Prices were tripling every day in November 2008, and at the height of the crisis, a loaf of bread cost 200 billion Zimbabwean dollars.

5. Yugoslavia hyperinflation in 90s

Both Serbia and Montenegro remained when the socialist Yugoslavia split in 1992. The government was compelled to turn on the printing presses and flood the country with unsafe banknotes as a result of a series of economic and political difficulties.

Hyperinflation reached 313 million percent in the first month of 1994, fuelled by UN sanctions and massive corruption. Every 34 hours, the price of the limited products that the merchants could provide doubled.

Residents in the former Yugoslavia parted with their money right away, without holding it for more than 1-2 hours after receiving it. Because there was nothing spectacular to spend their money on, throngs of people crossed Hungary’s border to buy necessities in a more or less rich neighboring country.

About the Author

Ankita is a German scholar and loves to write. Users can follow Ankita on Instagram ![]()

A Sudden Death of a Fantastic Singer: Vani Jayaram is no more

Vani Jayaram was really a fantastic South Indian singer who died in Chennai. His Tamil…

10 MYSTERIOUS PLACES AROUND THE WORLD, WILL HAUNT YOU !

MYSTERIOUS PLACES around the world are covered with mysterious secrets, and these secrets make these…

Amazing: Before and After pics

Analysing images taken before and after an event is an interesting experience, particularly when the…

6 WRONG BEAUTY PRODUCTS FROM THE PAST THAT RUINED BEAUTIES

Women have always understood that beauty involves sacrifice and have been willing to make it….

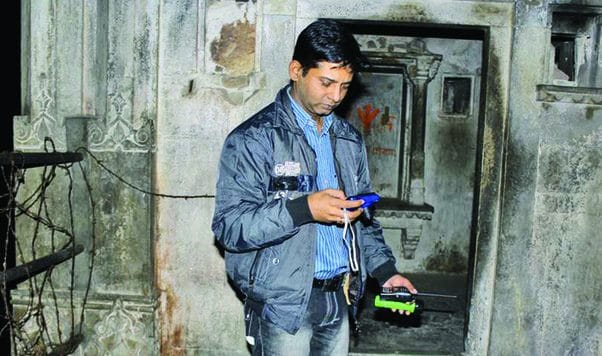

Was the death of ZeeTV’s ghost hunter Gaurav Tiwari a mystery ?

You must have probably heard and seen the name of Gaurav Tiwari, who claims to…

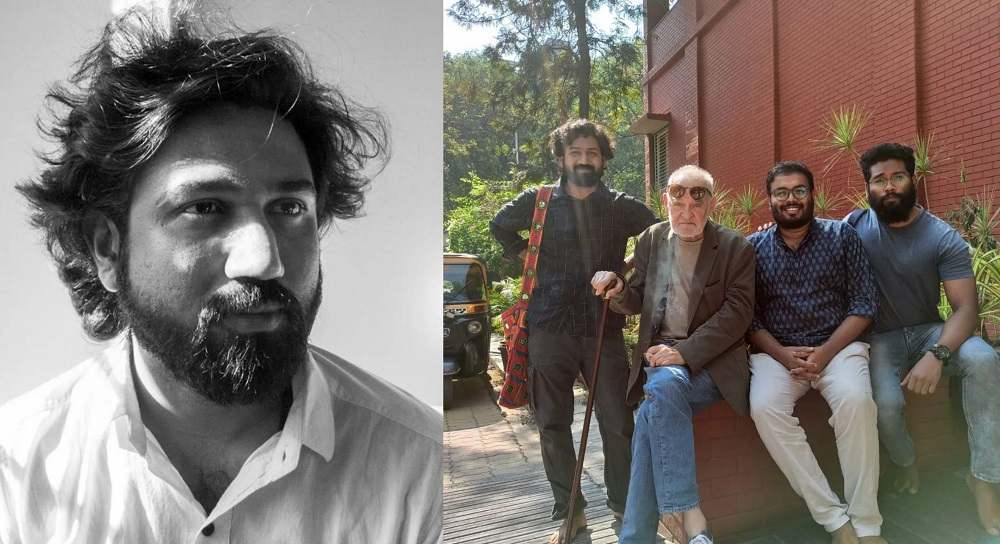

Who is Chidanand S. Naik ?

Chidanand S. Naik is an alumnus of the Film and Television Institute of India (FTII)…